Bond for the New Year

Why now is the time to buy (certain) bonds.

Most people know that a “balanced” portfolio includes both stock and bonds. I could happily debate modern portfolio design for hours (short version: due to recent breakdowns in classic correlation patterns, I think “modern portfolio design” understates risk and sets up users for rude surprises), but the important thing is that there are reasons and times to own bonds – and we are moving into a time when I believe it will make sense to own bonds.

Longtime readers will recall about a year ago I urged a bet AGAINST bonds due to inflation risks, and I put a chunk of money into that. By August it was clear that strong inflation was not materializing and we sold. Over that time the RRPIX rising rates fund (our anti-bond bet) went essentially nowhere but it did provide risk mitigation. If inflation had struck stocks would have gone down while RRPIX went up, effectively helping make our portfolio inflation resistant.

Now the risks have swung more toward economic weakness than inflation.

On Tuesday the Wall Street Journal published the results of a survey of 60 economists (Linkage: may require signup). The general sentiment was that the economy should do fairly well in 2007. The main quote: “The service sector should keep humming along as the recent weakness in housing and manufacturing abates and the Federal Reserve begins to reduce interest rates.”

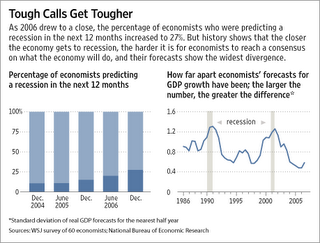

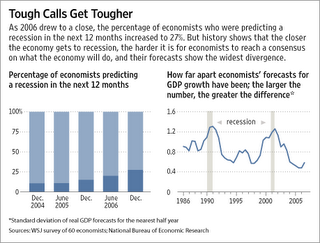

Figure: current economic estimates suggest things should be okay but not spectacular in the coming year. (Source: Wall Street Journal)

Figure: current economic estimates suggest things should be okay but not spectacular in the coming year. (Source: Wall Street Journal)

Some people think you want to buy bonds when the stock market goes down, and that is sort of true. You really want to own bonds when interest rates go lower, and that typically happens during market slowdowns because the economy is weak at the same time.

So what are the possible scenarios and the outcomes relative to adding some bonds to your portfolio?

I haven’t suggested bonds before now because we had a higher chance of stock market gains or inflation until now. The way the economy is shaping up now, though, it would be extremely hard for companies to continue their recent growth rate and inflation appears to be less of a threat.

What bonds to buy?

This article is already getting quite long and I’m going to have to ask you to bear with me while I continue my analysis. I’m looking at bonds like the Clear Channel 6.25% bonds due May 15, 2011 – non callable corporate bonds currently yielding 6.17% to maturity. I am going to continue to analyze corporate bonds and I will issue some buy calls soon. I will be using our secret weapons like the Z-score and bond analysis, but I won’t be rushing so it’s not ready now.

Invest well,

FW

Most people know that a “balanced” portfolio includes both stock and bonds. I could happily debate modern portfolio design for hours (short version: due to recent breakdowns in classic correlation patterns, I think “modern portfolio design” understates risk and sets up users for rude surprises), but the important thing is that there are reasons and times to own bonds – and we are moving into a time when I believe it will make sense to own bonds.

Longtime readers will recall about a year ago I urged a bet AGAINST bonds due to inflation risks, and I put a chunk of money into that. By August it was clear that strong inflation was not materializing and we sold. Over that time the RRPIX rising rates fund (our anti-bond bet) went essentially nowhere but it did provide risk mitigation. If inflation had struck stocks would have gone down while RRPIX went up, effectively helping make our portfolio inflation resistant.

Now the risks have swung more toward economic weakness than inflation.

On Tuesday the Wall Street Journal published the results of a survey of 60 economists (Linkage: may require signup). The general sentiment was that the economy should do fairly well in 2007. The main quote: “The service sector should keep humming along as the recent weakness in housing and manufacturing abates and the Federal Reserve begins to reduce interest rates.”

Figure: current economic estimates suggest things should be okay but not spectacular in the coming year. (Source: Wall Street Journal)

Figure: current economic estimates suggest things should be okay but not spectacular in the coming year. (Source: Wall Street Journal)Some people think you want to buy bonds when the stock market goes down, and that is sort of true. You really want to own bonds when interest rates go lower, and that typically happens during market slowdowns because the economy is weak at the same time.

So what are the possible scenarios and the outcomes relative to adding some bonds to your portfolio?

- What if the economy skyrockets next year? Your bonds return only their fixed income percentage (call it 5-8%) and you’ll miss out a bit on the difference between the bond income and the market rise. Chances: Of the 60 economists the WSJ surveyed, 8 thought next year would have GDP growth over 3% in the first half, and the highest was 3.4%. That suggests the best scenario for stocks would be in the 10-12% gain range for the year, but that this is an unlikely scenario.

- What if inflation jumps next year? This would hurt bonds badly. It would also hurt the stock market badly, although picking the right stocks can help you ride inflation to a certain degree. I dug through the raw data from the WSJ survey and out of 60 economists not a single one had any CPI guess above 3.5%. The Fed seems to have tamed inflation. Additionally, if this changes it should change slowly and give us time to get out.

- What if the market continues to meander along next year? No problem, we would collect bond income and be well positioned and hedged for when the economy goes down. Most probable scenario and a fine time to own some bonds.

- What if the economy slows down a little? No problem, an economic slowdown is the standard “ideal” time to own bonds because they continue to pay good income. Additionally if the Federal Reserve begins to lower rates bond holders will see some capital gains. Second most probably scenario and a fine time to own bonds.

- What if the economy (and market) tank? In this unfortunate scenario you will definitely be glad you hold bonds. The bonds will rise in value and help offset stock losses, while paying income you can invest at the market lows. Fairly improbable but according to market forecasts this is more likely that #1 or 2.

I haven’t suggested bonds before now because we had a higher chance of stock market gains or inflation until now. The way the economy is shaping up now, though, it would be extremely hard for companies to continue their recent growth rate and inflation appears to be less of a threat.

What bonds to buy?

This article is already getting quite long and I’m going to have to ask you to bear with me while I continue my analysis. I’m looking at bonds like the Clear Channel 6.25% bonds due May 15, 2011 – non callable corporate bonds currently yielding 6.17% to maturity. I am going to continue to analyze corporate bonds and I will issue some buy calls soon. I will be using our secret weapons like the Z-score and bond analysis, but I won’t be rushing so it’s not ready now.

Invest well,

FW

0 Comments:

Post a Comment

<< Home