A Bet against Bonds

The economy is building remarkable strength but a lot of forces are leaning toward inflation. If you buy inverse bond funds such as Rydex Juno fund [RYJUX] or Profunds Rising Rates Opportunity [RRPIX] you can make some money off inflation instead of watching your pocketbook get weaker.

A lot of hot economic data has come out recently. Gross domestic product data released by the Commerce Department Friday shows a 4.8% annual rate of growth January through March, the highest quarterly number since 2003. Consumer spending was up by 5.5%, also the highest since 2003. Durable goods orders were up 20.6% during the same period and business spending jumped 14.3%, which is a level it hasn’t reached since 2000 but my ongoing analyses of various stocks doesn't show the sorts of channel stuffing and fake income that we saw during the bubble.

Overall pay rates grew 0.7% over the first 3 months of the year, equivalent to a 2.8% yearly rate (recent data shows a better 4.8% hourly pay increase, so both numbers together imply there is room for more hours to be billed), which is still enough to make up for the reduction in cash out refinancing, although inflation may eat into the consumer’s purchasing power.

Even more amazingly, existing home sales actually rose by 0.3% in March (after rising 5% in February), although the deceleration in growth was accompanied by massive increases in unsold home inventory. I do think that the real estate market is going to get bloody in the next year, though.

Finally the conference board consumer confidence index actually increased to 109.6 from 107.5 in March.

Previously here on the Finance Wonk we have looked at the influence of cash out refinancing and payrolls on bond rates, as well as delta hedging and unwinding the carry trade. Yesterday, China raised rates unexpectedly and Japan has been raising rates a fair amount recently. Any hedge funds still in the carry trade should be running for the door if not already done and clear so we should soon see reduction in the cash flows unwinding the carry trade. Delta hedging makes money off of volatility and rising short term rates in particular. Yesterday Ben Bernanke’s comments made it clear that the Federal Reserve was considering pausing in rising rates, which should lower the forces due to delta hedging. Those of you who reread about recent shipping data will see another indicator that rates should be higher.

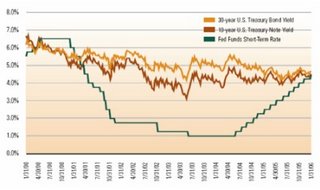

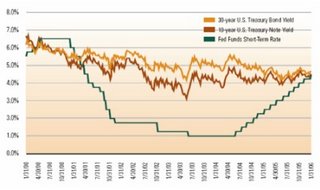

If we remove the forces of delta hedging and the carry trade which have been artificially depressing long term rates, I see a strong possibility for bond rates to jump up. The plot below shows some recent historical data on fed rates and bond rates. The Federal Reserve rates have collided with bond rates because bond rates have been held down by market forces – but those market forces are now cutting loose. I think that we will see a significant upswing in long term interest rates in the next year. There was a similar collision in 2000, but that was in the context of a crash where the bond rates fell into the fed rates due to a lag in government response. Now we have the fed rates coming up in a strong economy to push up the long term bond rates.

How sure am I? My buy order for RRPIX is already in before I post this. I have a slight preference for Rydex as a company, but in this category the Profunds offering has 1.25 times the movement of the Rydex RYJUX fund. (It looks from the logs like people from Rydex Funds are reading this site. Feel free to contact me through the email in my profile, I'd love to talk.) Note that these are both Mutual Funds and not exchange traded funds (ETFs), so make sure to check your brokerage fees and conditions. (Those good folks at Rydex seem to be working on developing their offerings into ETFs, which would be very convenient. I would love to be able to buy a Rydex ETF to build this position.)

Bond rates don’t move as fast as stocks do so don’t expect this position to move very fast, but it could give a very nice hedge against inflation. When bonds start to reach higher interest rates, I intend to get out of RRPIX and into bonds themselves – but we’ll analyze that move as it approaches.

A lot of hot economic data has come out recently. Gross domestic product data released by the Commerce Department Friday shows a 4.8% annual rate of growth January through March, the highest quarterly number since 2003. Consumer spending was up by 5.5%, also the highest since 2003. Durable goods orders were up 20.6% during the same period and business spending jumped 14.3%, which is a level it hasn’t reached since 2000 but my ongoing analyses of various stocks doesn't show the sorts of channel stuffing and fake income that we saw during the bubble.

Overall pay rates grew 0.7% over the first 3 months of the year, equivalent to a 2.8% yearly rate (recent data shows a better 4.8% hourly pay increase, so both numbers together imply there is room for more hours to be billed), which is still enough to make up for the reduction in cash out refinancing, although inflation may eat into the consumer’s purchasing power.

Even more amazingly, existing home sales actually rose by 0.3% in March (after rising 5% in February), although the deceleration in growth was accompanied by massive increases in unsold home inventory. I do think that the real estate market is going to get bloody in the next year, though.

Finally the conference board consumer confidence index actually increased to 109.6 from 107.5 in March.

Previously here on the Finance Wonk we have looked at the influence of cash out refinancing and payrolls on bond rates, as well as delta hedging and unwinding the carry trade. Yesterday, China raised rates unexpectedly and Japan has been raising rates a fair amount recently. Any hedge funds still in the carry trade should be running for the door if not already done and clear so we should soon see reduction in the cash flows unwinding the carry trade. Delta hedging makes money off of volatility and rising short term rates in particular. Yesterday Ben Bernanke’s comments made it clear that the Federal Reserve was considering pausing in rising rates, which should lower the forces due to delta hedging. Those of you who reread about recent shipping data will see another indicator that rates should be higher.

If we remove the forces of delta hedging and the carry trade which have been artificially depressing long term rates, I see a strong possibility for bond rates to jump up. The plot below shows some recent historical data on fed rates and bond rates. The Federal Reserve rates have collided with bond rates because bond rates have been held down by market forces – but those market forces are now cutting loose. I think that we will see a significant upswing in long term interest rates in the next year. There was a similar collision in 2000, but that was in the context of a crash where the bond rates fell into the fed rates due to a lag in government response. Now we have the fed rates coming up in a strong economy to push up the long term bond rates.

Plot of the fed rates (solid green line), 30 year treasury rates (tan jagged line), and 10 year treasury rates (red jagged line) for the last 6 years. In the current economic environment I expect the current collision to result in bond rates moving upward. This plot is from a ProFunds document.

How sure am I? My buy order for RRPIX is already in before I post this. I have a slight preference for Rydex as a company, but in this category the Profunds offering has 1.25 times the movement of the Rydex RYJUX fund. (It looks from the logs like people from Rydex Funds are reading this site. Feel free to contact me through the email in my profile, I'd love to talk.) Note that these are both Mutual Funds and not exchange traded funds (ETFs), so make sure to check your brokerage fees and conditions. (Those good folks at Rydex seem to be working on developing their offerings into ETFs, which would be very convenient. I would love to be able to buy a Rydex ETF to build this position.)

Bond rates don’t move as fast as stocks do so don’t expect this position to move very fast, but it could give a very nice hedge against inflation. When bonds start to reach higher interest rates, I intend to get out of RRPIX and into bonds themselves – but we’ll analyze that move as it approaches.

0 Comments:

Post a Comment

<< Home