Correlation, what it is and why it's failed

Correlation is the tendency of numbers or indexes to move together. Two values with 100% correlation move together in the same direction and with one you can predict the other. As correlation gets down around 30% two values start to look visually like they have no influence on each other, and a correlation of zero means having one number gives you literally no information about the other. Negative correlation numbers mean the values move in opposite directions (one goes up when the other goes down) but -100% still means one number predicts the other. Your height and the distance between your head and the ceiling have a -100% correlation, one predicts the other but if you get taller the distance to the ceiling gets smaller.

In stock investing correlation (specifically a low correlation) is the key to building a diversified portfolio. Diversification is NOT just a matter of buying a handful of different stocks. In an ideal situation you can carefully use the correlation numbers to calculate how much of a variety of different asset classes you should own to reduce the volatility of your portfolio. In years past the idea was that as US stocks went down, for example, emerging market stocks might very well go up.

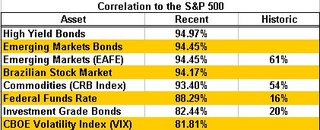

In recent years formerly different asset classes have started moving together. It started in the late 1980s and through the 1990s with foreign stocks as international trade connected. Recently commodities and stock markets have linked up as growth has led to increased demand. Now if you look past at the last dozen years the correlation looks like this.

Until two years ago there was always something less than 40% correlated with the stock market. No longer. Now if you have a portfolio of US stocks, overseas stocks, bonds, commodities, and even emerging market bonds you are seeing such a high correlation that the diversification effect is almost eliminated. This is quite a problem to any investor who still wants to diversify.

Some of the changes are fundamental: as economies connect foreign and domestic markets naturally move together. This trend will probably continue in fits and starts into the future. Imagine a world hundreds years from now where everyone in the world has the same products and luxuries and it seems natural that worldwide markets should move together. Other linkages are less obvious, for example bonds and stocks should move in separate cycles for very fundamental reasons.

But why is everything moving the same way now? The answer is that investors have a lot more money than usual right now (or “liquidity”). The incredibly low interest rates that the worlds’ banks used to fight economic slowdown (the Japanese were lending money at almost 0% interest for years) have resulted in huge amounts of money chasing all assets. Any asset that hadn’t risen yet saw a huge influx of cash as desperate investors looked for something to buy with their cash that hadn’t already been bid up to high prices.

At the end of January Ned Davis Research found that the following indicators were all at four-year highs (on a month-end basis): the S&P 500 stock index, Japan's Nikkei-225, Germany's Xetra Dax index, gold prices, and the Current Commodities Futures Index. The data for gold spot prices in comparable form is only available back to 1968 but in all that time this has never happened before.

Even the Japanese central bank has recently announced an end to the easy-money times. At some point a bunch of these assets will presumably start to fall as the money seeks the proper assets to be in. We can only hope that the new correlation of the markets doesn’t continue, because that would mean all the assets falling at once and very few safe places to be.

0 Comments:

Post a Comment

<< Home