Dow Chemical (DOW) analysis and rating

As background I first started looking at DOW 8/3/05, when it had a price/cash flow ratio of 9.4, very good (lower is better) for a growing firm but not so good for a stock without room to grow. The implied discount rate on future earnings was 17%, which is solidly above the 15% I like to see, and the dividend was 2.8%. The stock was trading at $47.50 and was being recommended by various pundits and magazines. Despite the promotion by various writers I didn’t like the recent analyst downgrades and the debt ratio at the time. Analysts tend to lag reality and a slight change in growth rates can seriously impact the implied discount rate (see my previous post for relation to target price).

My notes at the time were “Excellent earner with solid cash flow and dividend. Recent downgrades though, may get cheaper shortly.”

Last month on 3/30/06 I revisited it again, and the price was down 14% from my first analysis. Looking at the straight numbers would give a price/cash flow ratio of 6 and net discount value of 21% but recent results had indicated the business was contracting. I don’t have any fear of struggling companies, I just demand a sizable discount and so should you.

Now the Q1-06 numbers are out. Net Income slid 10% to $1.21Billion but profit was $1.24 a share versus forecast of $1.17. So what do we do when income is down but profit is better than forecast? Hopefully we do the same thing as always and analyze the company dispassionately. Management always manages to put a positive spin on things. I can’t count the number of losing stocks I've held in the past because the managers on the conference call expressed confidence in the future and that things are improving. Management always has to see, and believe, things will go well. The numbers don’t lie, and I rely on them now to avoid getting fooled.

Cash flow looks to be about $1.76 Billion by my estimates (depreciation numbers aren’t out yet as usual, but I do like to trade ahead of the crowd and depreciation usually isn’t a volatile number so I estimate it). I can combine cash flow with the trailing 3 quarters to get $6.5Billion, which is actually below where it was six months ago, market cap is $40Billion so the price/cash flow is down around 6. I’m glad I didn’t buy this back when the magazines were recommending it. This price to cash flow ratio is a reasonable number for a large industrial company without growth, which is what we seem to be looking at here, and much better than the ratio of 9.4 it had last August. Now comes the tricky part: the average analyst 5 year growth rate is 7%, which would imply (using similar analysis to here) a discount rate of 20% or an implied target price (I hate that) of $86.40. Please raise your hand if you believe this is a good number and the stock of Dow Chemical is undervalued by more than a factor of 2. No hands? Good. This is a large industrial company that is not innovating new business at the moment. For this particular company I think it will be hard to grow much more than the overall economy. Management may get smart and turn things around but if they do we will have a chance to get in AFTER they start to make a recovery.

Let’s turn the problem around for a moment and say we want to see an implied discount rate of 15% (my current rule of thumb for buying something) and ask how well the company would have to grow to justify that. The answer works out to around 2.3%, which is a reasonable long term economic growth rate, and thus something DOW might reach. I really don't like the feeling of a company with recently slowing sales but if nothing else is wrong the market may be undervaluing DOW.

DOW passes my first main screening tools: price to cash flow and discount rate. This means it qualifies for some in depth reading. This is where the analysis gets complicated because the numbers so far look good, but I’m going to rate this company SELL.

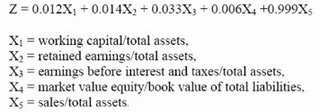

I noted the debt concern before so check in on that again. It looks like DOW still has about $12Billion in debt. The sales to asset ratio is fairly high so I go ahead and calculate the Z-Score for Dow Chemical. Think of the Z-score like the consumer credit score that decides how likely a person is to get a car loan, only at the corporate level. The Z-score was adopted in the economic community in 1986 to statistically predict company bankruptcy chances. Unlike the rating systems at S&P or Moody’s the Z-score formula is public so anyone can use it and has decades of academic analysis on it. A full treatment can be found in this paper, and runs to 54 pages. Here is the ultra-super-short Wonk Notes version of it:

The super short version of how to compute a Z-score for a company. The Z-score is like the consumer credit rating you are probably familiar with, except for large companies. The Z-score for DOW indicates a high risk of corporate disaster.

The Z-score for Dow Chemical through the beginning of 2006 is just above 1, which is astoundingly low. The cutoff for predicting bankruptcy has been drifting over time but a rating this low indicates something like a 30% plus risk of bankruptcy or major corporate restructuring within 3 years. Mind you, a 30% chance of failure is still a 70% chance of pulling through, but for the minimal upside here I prefer to wait a while to see how this shakes out. From the computation of the Z-score the primary issue seems to be the low sales to assets ratio. I am shocked to see how high the bonds of Dow Chemical are rated (glancing at the trading data I’m seeing A3/A- ratings). Maybe one could benefit from selling Dow bonds short, but that’s not a tactic I engage in, just because it can go spectacularly wrong.

Reviewing all the data I think the good price to cash flow ratio and cheap appearing stock may be due to people with good information selling this stock as it sinks. I would tread very cautiously and don’t want to own it. DOW may recover and may even be up a bit a year from now, but it has higher risk than most people appreciate. The risk/reward qualities aren’t good enough. You can do better.

Dow Chemical [DOW] gets a SELL from the Finance Wonk.

1 Comments:

There is a discussion on your sell call on yahoo: http://finance.yahoo.com/q/mb?s=DOW

Please read and maybe post on the comments?

Post a Comment

<< Home