The economy has a pulse, and it's name is shipping

Recently an excellent bit of data became available for U.S. economy watchers: Package shipper UPS and rail transporter Union Pacific both issued their first quarter reports.

UPS had a revenue increase of 16.5%. If we pick that number apart we find that domestic US package volume was up 6.8% and, importantly, domestic package revenue grew faster than volume at 9.6% indicating pricing power and people opening up their wallets to use more expensive shipping options. International volume rose 29%, but UPS has been adding routes internationally so it isn't necessarily a good measure of the actual shipping market status. If one compares the European trend (accelerating growth) the US trend (reduced growth acceleration, but still growing) and Asian trend (massive growth) you can see a microcosm of economic progress reported without politicians getting in on it.

Union Pacific likewise improved both shipments and the prices they charged. Union Pacific breaks down their data even finer, though, showing 26% revenue increase on agricultural shipping, and 23% increase in automotive, industrial, and intermodal (freight containers from ships). Fuel prices were up 29% but the increased prices to their customers more than compensated, which is a very good sign.

Both companies reported expectations of continued strong demand and pricing.

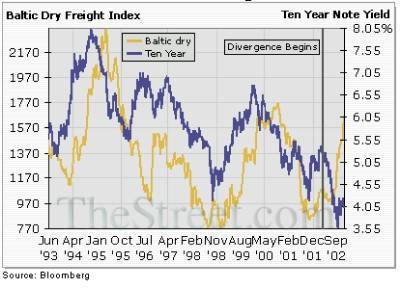

Shipping data is useful because it doesn't have speculation in it: People may be buying oil futures to game the system and make money off speculation, but you don't ship a package unless you have something that needs moving. If you like the idea of monitoring shipping to keep an eye on the economy, let me introduce you to the "Baltic Dry Index" of shipping. The Baltic Dry Index (available on Bloomberg as ticker BDIY or sign up with the Baltic Exchange) is compiled by the London-based Baltic exchange. Every day they call shipping companies around the world and price shipping for 150,000 tons of various dry goods (iron, coal, grain,etc.) on various routes. The resulting prices are aggregated into an index value that shows the global price of shipping raw materials. The shipping supply is fairly inelastic, so the index moves fast at times but shipping correlates well (on a lag) to the need for capital. A few years ago Howard Simons at Thestreet.com put together a chart comparing the Baltic shipping index to Bond prices, which is worth a look. I have reproduced the plot here, although full credit goes to Mr. Simons:

Baltic Dry Index compared to ten year bond rates, showing an amazingly strong lagging correlation. (Credit TheStreet.com)

Baltic Dry Index compared to ten year bond rates, showing an amazingly strong lagging correlation. (Credit TheStreet.com)

Simons comes to the conclusion that the BDIY index does an excellent job of following 10-year interest rates on about a 1 year lag. At least this was the case right up until 2002, when the two diverged. If you have been reading the Finance Wonk, this won't strike you as even remotely surprising since we know that there have been recent market forces holding down long term bond yields. In recent years the BDIY shot up to nearly unprecedented levels (see this amazing chart of 2000-2003 BDIY behavior). This provoked additional shipbuilding and (after a suitable delay because building shipping takes a while) the BDIY is finally getting back down to reasonable, but elevated levels. This shows a strong woldwide demand for basic bulk goods, the precursors of economic manufacturing, and is a solid leading manufacturing indicator without speculative influence. I consider the BDIY more useful than the futures market or spot prices of commodities because the futures are prone to speculative excess, but freighters don't get booked until real world goods need to move.

So what does this mean? Well, it suggests continued world economic strength (as opposed to a weak BDIY during the dot-com bubble, for example). It also suggests that there could be a LOT of pent up bond rate increases on longer dated bonds. When bonds move, it may be quite dramatic, and that move in turn could cause some chaos in world markets. Watch those inverse bond funds. I am keeping an eye on Rydex RYJUX and Profunds RRPIX. With all this mention of inverse bond funds you may wonder if I work for one of these companies. I do not. I don't even own any of these funds as of this moment although it would have been nice to own it for the last month and I may buy some soon.

0 Comments:

Post a Comment

<< Home