Making my call on the economy for the day

In a recent post I calculated that a cash out home refinancing drop of 50% in 2006 would reduce consumer spending by 1.8% and could reduce the growth of consumer goods companies.

Well, the average hourly wage data is out at the bureau of labor statistics and hourly earnings are expanding at a 4.8% annual pace, more than enough to compensate for the decline in cash out refinancings. My call of the moment: the consumer will have enough cash to keep going unless gas prices get really out of hand.

Well, the average hourly wage data is out at the bureau of labor statistics and hourly earnings are expanding at a 4.8% annual pace, more than enough to compensate for the decline in cash out refinancings. My call of the moment: the consumer will have enough cash to keep going unless gas prices get really out of hand.

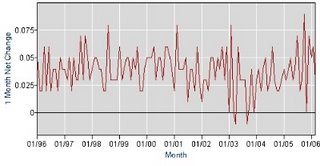

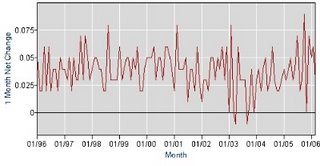

Ten years of month to month average hourly production wage growth (source: Bureau of Labor Statistics). Current wage growth is more boom-like than bust-like and is more than enough to offset reduction in real estate cash out refinancing.

That's all for this quick update. I have more cooking for later, possibly today.

2 Comments:

Where did you find that stat?

All I found was this table which shows 0.2% for March.

http://www.bls.gov/news.release/realer.t01.htm

I see where you are getting the 0.2% preliminary number for March. I was using the 0.4% revised number from February as reported April 8th in the wall street journal:

http://online.wsj.com/article/SB114441234065719966-search.html?KEYWORDS=hourly+wage&COLLECTION=wsjie/6month

This revised data does not seem to have made it onto the BLS site yet.

Now that I am looking in more depth I agree that perhaps we should expect something closer to 3.5% year over year growth.

Good observation!

Post a Comment

<< Home