Apple Computer gets a BUY

The statement is so startling because it’s an overstatement, of course, but the fundamental behind it is that tech companies can have their fate change on a dime. Technology changes, peoples habits change, and suddenly the unstoppable giant can find itself adrift and irrelevant. Consider the graveyard of tech giants such as Digital Equipment Corp (DEC) or Atari (the new Atari is a different business).

When thinking about this state of affairs I realized that Apple computer isn’t really a tech company, it’s more of a branding business. The iPod is technically quite similar to many gadgets before it, but the ease of use and heavy advertising made it the monster it is today. The tech world is full of fancy gadgets, but in many cases they don’t become relevant until enough people are using them that they seem worth the effort – call it gadget peer pressure.

When investing in tech you also need to wait for the growth to “hit”. You might miss the first doubling of the stock, but I find that getting greedy and trying to buy before a company gets its mojo going is a sure way to end up with lots of duds in your portfolio. I prefer to wait until the upswing has started so I can wrap my brain around the business and see how management will handle things. It also gives one some numbers to calculate against.

Diving right in to Apple Computer [AAPL], let’s start with the net present value. I have posted a detailed overview of how to calculate the present value of a company so I won’t go over it again here, click this link to see how the math works. In this case the net income for the last 4 quarters is $1.724 Billion, the company has no long term debt, and I will apply my usual (and highly demanding) discount rate requirement of 15%. These numbers together suggest that Apple will need 10 year growth of 15.2% annually to justify its current price. Analysts project a growth rate of 19.7%, so this looks tentatively okay for the moment. Let’s dig deeper into the numbers.

First of all I went through the annual and quarterly reports looking for traps. There is no pension problem (such as sunk the UPS rating), but I did find a typical gotcha for tech stocks: lots of employee options. The total number of options waiting to be exercised is about 100 million including both those that are exercisable and those that are issued but not vested yet. Not all of those will necessarily be exercised, but it’s a good estimate for the future option burden. Specifically 100 million shares of options versus 850 million actual shares currently outstanding is an 11.7% dilution. When I adjust the earnings for this dilution the growth will need to be 16.8% to justify the current share price. 10 years of 16.8% growth is 4.7x current earnings. 10 years of 20% growth is 6x current earnings.

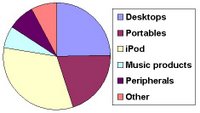

So how reasonable is the analyst projected growth rate of 19.7% ? My first concern is that current growth has been driven by iPods, which don’t have much further to grow, so I broke down AAPL’s sales by product category. Using data from 2005 I see 25% desktops, 20% Laptops, 33% iPods, 6% Music, and 16% comes from peripherals, software, and other sundries.

Chart of revenue by product line for Apple Computer. The good news here is that Apple can still easily see large amounts of growth without relying on the iPod, which already has massive market penetration.

This chart is pretty good news. Despite the tremendous iPod growth the Mac systems are still a major part of the revenue chain (45%). Why is this good? Because Macs are still only 3% of the computer market, so if they grow to just 4% of the market it means growing 45% of Apple’s sales by 30% -- or an overall 13.5% sales growth right there. I’m sure you’ve seen the recent onslaught of ads for Macintosh computers (are they even called that anymore, or is it just “Mac”?). I think the iPod is a great lever for AAPL to get in the door and sell more computers.

What about margins? Well, as luck would have it I happen to have what industry folks call a “teardown report” on an iPod. This is a report where a team of engineers has pulled apart an iPod, pricing every component and assembly technique to figure out how much it costs to make. It looks like the classic iPods are getting about a 50% margin, while the nanos are a bit less (but probably improving – it’s all about the NAND prices). Running some math on the earnings and the published total gross margin for Apple at 29% we can calculate that the Macs are probably in the 10-25% margin range. That’s not bad at all considering how DELL and HP squabble and fight over 8-9% margins. Ahh… the power of branding. Good margins keep the range of sales growth needed to establish earnings growth in a reasonable range.

It is well within imagination to see Mac selling 5-8x more stuff 10 years from now. And we haven’t even discussed new products yet. Apple and Motorola made a pretty lousy phone together (the ROKR), but it made obvious Apple’s tactic was to use Motorola to learn to make cell phones. I expect Apple will soon replace our nanos and cell phones with, FINALLY, a combination gadget that everyone will buy. We should try to buy stock before then.

Last, but not least, I have visited Apple computer, talked at length with their engineers, and eaten alongside them in their cafeteria. The organization works and you can feel the energy and new products in a way that I haven’t felt at most companies I’ve visited. I’m glad the numbers work out, Apple gets a BUY.

I will probably wait a short while to buy this stock. If you read my post on this weeks market moving events you’ll see why I will wait until at least Wednesday to make my move. When I buy in, I’ll post my BUY call and the price I was in at in the right hand column with all the others.

Invest well…

the finance wonk.

1 Comments:

Great analysis. I am a avid reader of your blog and market commentary. Also am a shareholder of LECO.(bought in April and from the LECO messageboard got a link to your blog.) The current downturn has been swift and I did not have an opp. to get out completely but thanks to you for urging to go to cash last weekend.

Keep up the good work.

Regards,

Chowdary.

Post a Comment

<< Home