Custom Inflation Number Crunching

Which industry should we invest in now and how long will the economy hold up? Inflation holds the answers to both, read on...

It can be hard to get the straight story on inflation. Most of the talking heads associated with banks or investment houses know perfectly well that they stand to profit if things go a particular way, and that inflation is susceptible to expectations of the crowds. So it is only sensible that these "experts" tend to advocate the future scenario that benefits their organization.

An unintentionally humorous study a few decades back looked into the opinions of bankers on the advisory commitee to the Federal Reserve. It found that these bankers advised raising rates fully twice as frequently as economists, and often all the way into recession. Why? Banks make more money when rates go up.

So how do we get the straight dope? Well, that's where we have to dig into the numbers. The Finance Wonk (that's me) only makes money by getting it right in the market. So I set out to draw information out of the recent inflation data.

One little appreciated detail of inflation is that typically it has both winners and losers. If housing prices are rising but food prices are dropping people in the housing industry will be getting raises and seeing a good economy, while those who make food will see decreasing money amid rising house prices and will lose out. This push-and-pull is what makes it so hard for the government to set inflation rates, they essentially have to decide when the situation is unfair enough to warrant restraining the economy and forcing losers to get hurt more.

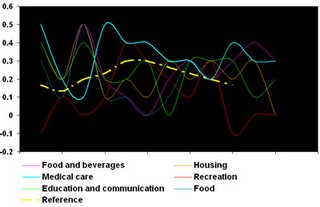

This next plot, although it looks like a mess. Is a simplified plot of inflation data back to November of 2005, separated out by sector. I have removed energy, transport, apparel, and a few other wildly chaotic traces that don't contribute much information. (Inflation data is CPI from Bureau of Labor Statistics, gathered and processed by the Finance Wonk.)

Plot of CPI monthly inflation percent from November 2005 to the present. Wildly varying lines (energy, apparel, transport) have been removed. The dot-dashed yellow line is a smoothed average of core inflation. The clear winner is medical care (light blue line) which has been steadily above the average. Most of the others do not appear to be gaining advantage during this economic cycle.

Plot of CPI monthly inflation percent from November 2005 to the present. Wildly varying lines (energy, apparel, transport) have been removed. The dot-dashed yellow line is a smoothed average of core inflation. The clear winner is medical care (light blue line) which has been steadily above the average. Most of the others do not appear to be gaining advantage during this economic cycle.

The line for Medical spending (light blue) is consistantly above the core average, which tells us that medical industries are able to charge steadily more and have had strong pricing power for over a year. So this could be a promising sector in which to ride out any downturn (I will be looking there for investments shortly).

It can be hard to get the straight story on inflation. Most of the talking heads associated with banks or investment houses know perfectly well that they stand to profit if things go a particular way, and that inflation is susceptible to expectations of the crowds. So it is only sensible that these "experts" tend to advocate the future scenario that benefits their organization.

An unintentionally humorous study a few decades back looked into the opinions of bankers on the advisory commitee to the Federal Reserve. It found that these bankers advised raising rates fully twice as frequently as economists, and often all the way into recession. Why? Banks make more money when rates go up.

So how do we get the straight dope? Well, that's where we have to dig into the numbers. The Finance Wonk (that's me) only makes money by getting it right in the market. So I set out to draw information out of the recent inflation data.

One little appreciated detail of inflation is that typically it has both winners and losers. If housing prices are rising but food prices are dropping people in the housing industry will be getting raises and seeing a good economy, while those who make food will see decreasing money amid rising house prices and will lose out. This push-and-pull is what makes it so hard for the government to set inflation rates, they essentially have to decide when the situation is unfair enough to warrant restraining the economy and forcing losers to get hurt more.

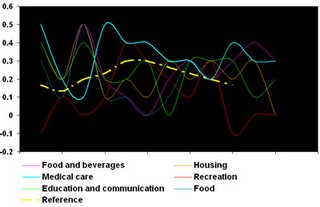

This next plot, although it looks like a mess. Is a simplified plot of inflation data back to November of 2005, separated out by sector. I have removed energy, transport, apparel, and a few other wildly chaotic traces that don't contribute much information. (Inflation data is CPI from Bureau of Labor Statistics, gathered and processed by the Finance Wonk.)

Plot of CPI monthly inflation percent from November 2005 to the present. Wildly varying lines (energy, apparel, transport) have been removed. The dot-dashed yellow line is a smoothed average of core inflation. The clear winner is medical care (light blue line) which has been steadily above the average. Most of the others do not appear to be gaining advantage during this economic cycle.

Plot of CPI monthly inflation percent from November 2005 to the present. Wildly varying lines (energy, apparel, transport) have been removed. The dot-dashed yellow line is a smoothed average of core inflation. The clear winner is medical care (light blue line) which has been steadily above the average. Most of the others do not appear to be gaining advantage during this economic cycle. The line for Medical spending (light blue) is consistantly above the core average, which tells us that medical industries are able to charge steadily more and have had strong pricing power for over a year. So this could be a promising sector in which to ride out any downturn (I will be looking there for investments shortly).

The dash-dotted yellow line shows a moving three month average of core inflation. The fact that this has slowly reversed and turned downward over the last year is important. It indicates that either inflation is remarkably tame in a growing environment, or that the economy is slowing down. To determine which of these directions things are trending in we can look at the ISM manufacturing indexes to see how industry is doing.

The ISM numbers are really quite frightening. They collect surveys among industry to gather 11 index values that measure how production is doing in the U.S. After 41 consecutive months of growth, 8 of the 11 indexes are showing a contracting economy and the remaining three are slowing down towards a contraction. It's really amazing, you can see all the data at this link. Keep in mind that for 41 months in a row (until now) those indicators were positive!

When they asked their survey questions here are some of the comments they got:

- "Sales have leveled off, but we will have a record year. Second [year] in a row." (Computer & Electronic Products)

- "Business has softened in the past 60 days. Down about 20 percent." (Fabricated Metal Products)

- "Housing market slowed down." (Furniture & Related Products)

- "We have hit another slow period in receiving new contracts. Quoting activity is fair." (Machinery)

- "We are still trying to hire new maintenance techs, but find it difficult to find qualified people." (Nonmetallic Mineral Products)

This is all very concrete data, unlike the wishful thinking you hear from the folks on TV. None of these data sources stand to gain from this data.

I have solidified in my view that we are closer to the top than the next market bottom, but there may still be some sentiment-driven rise left. Defensive moves are advisable.

Invest well,

FW

0 Comments:

Post a Comment

<< Home