Weekly Look Ahead

The four month rally was powered by merger news, strong earnings, and an influx of money that had been waiting on the sidelines.

Last week people got a taste of some less than optimistic news and the market took quite a beating. The real question now is how much longer the market can stay afloat before negative sentiment sets in.

My opinion on the matter is that there is still plenty of money on the sidelines and earnings probably aren't about to crash, so the market could hold up for quite a while. I do think, however, that we are closer to the top than we are to the next bear bottom. I continue to advise people to react conservatively. Pick stocks (like those on my buy list) that have very strong fundamentals, and put aside some cash for when things go down.

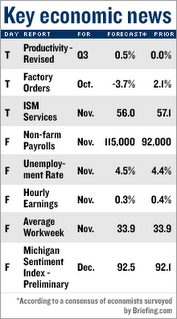

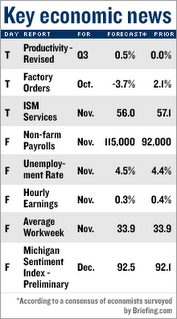

If payrolls and unemployment reports out this week are as positive as projected (see chart below), the market could recover a bit this week. On the flip side, market valuations currently have a very rosy future built into their pricing. Ask yourself this, could profits double from here in the next few years before a pullback? Seems unlikely, but unless that happens there is little point buying many stocks right now. Overall I think the market is likely to be turbulent for a while then move into a bear market -- although that might be as much as a year away.

Last week people got a taste of some less than optimistic news and the market took quite a beating. The real question now is how much longer the market can stay afloat before negative sentiment sets in.

My opinion on the matter is that there is still plenty of money on the sidelines and earnings probably aren't about to crash, so the market could hold up for quite a while. I do think, however, that we are closer to the top than we are to the next bear bottom. I continue to advise people to react conservatively. Pick stocks (like those on my buy list) that have very strong fundamentals, and put aside some cash for when things go down.

If payrolls and unemployment reports out this week are as positive as projected (see chart below), the market could recover a bit this week. On the flip side, market valuations currently have a very rosy future built into their pricing. Ask yourself this, could profits double from here in the next few years before a pullback? Seems unlikely, but unless that happens there is little point buying many stocks right now. Overall I think the market is likely to be turbulent for a while then move into a bear market -- although that might be as much as a year away.

0 Comments:

Post a Comment

<< Home