Weekly Look Ahead

Most of Wall Street will be back after a long 4 day weekend, still groggy from too much turkey and eggnog and staring bleary eyed at the shopping results from the weekend.

Friday night initial reports showed rather weak consumer sales that would have been scary for the upcoming week, but the final results for the weekend were very strong. Average sales per shopper over the Thanksgiving shopping weekend was $360.15, up 18.9% from last year. Current projections are for a gain of about 6% in total sales over last year. More details from CNN here. Original data is from ShopperTrak, see here.

The shopping news is certainly enough to brighten up the prospects for investors, but it is largely priced into stocks already. In fact numerous worrywarts on the street are concerned that the recent market surge leaves stocks priced for the brightest possible future. That very concern may mean the bull market has a bit of steam left in it though, as typically the market doesn't roll over into a bear until everyone has become optimistic and puts their money in.

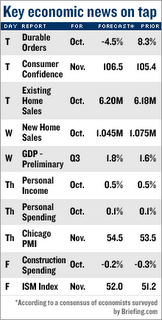

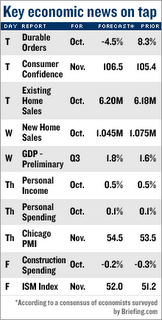

For those who believe the market has some sanity to it, however, there is plenty of news coming out this week. If economists are right the durable orders data on Tuesday could be quite a splash of cold water as the predictions call for a decline in orders. Last month would have had a decline if not for massive military and jet orders piling up in that report. Construction spending will also probably be down this week. There are plenty of things that could be seen as bad news this week, it just remains to be seen whether people will instead see them as inflation preventers and thus potential good news. My prediction is that this week will be about market Psychology.

Friday night initial reports showed rather weak consumer sales that would have been scary for the upcoming week, but the final results for the weekend were very strong. Average sales per shopper over the Thanksgiving shopping weekend was $360.15, up 18.9% from last year. Current projections are for a gain of about 6% in total sales over last year. More details from CNN here. Original data is from ShopperTrak, see here.

The shopping news is certainly enough to brighten up the prospects for investors, but it is largely priced into stocks already. In fact numerous worrywarts on the street are concerned that the recent market surge leaves stocks priced for the brightest possible future. That very concern may mean the bull market has a bit of steam left in it though, as typically the market doesn't roll over into a bear until everyone has become optimistic and puts their money in.

For those who believe the market has some sanity to it, however, there is plenty of news coming out this week. If economists are right the durable orders data on Tuesday could be quite a splash of cold water as the predictions call for a decline in orders. Last month would have had a decline if not for massive military and jet orders piling up in that report. Construction spending will also probably be down this week. There are plenty of things that could be seen as bad news this week, it just remains to be seen whether people will instead see them as inflation preventers and thus potential good news. My prediction is that this week will be about market Psychology.

0 Comments:

Post a Comment

<< Home