Weekly Look Ahead

Hmm... blogger seems to be eating articles today. I'll pretend I had something brilliant to say in my previous version :)

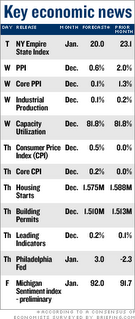

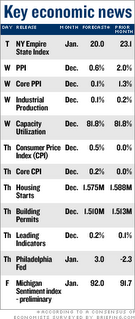

Bottom line is this: we are headed into the busy economic and earnings season. Investors will be looking for hints on where the economy is going, especially given all the recent changes in the investing situation. The december shopping season was stronger than expected, but oil is dropping fast and much of the market earnings gains have been due to oil companies. We've enjoyed a market pop upward due to declining oil but now we face potentially lower earnings reports due to the same thing. Overall it's better for the economy if people aren't spening as much on oil, but in an uncertain environment lower earnings growth is likely to result in unhappy stockholders.

How bad will the earnings be? Current projections are that this will be the first quarter in a very long time with single digit growth in earnings (year over year basis). Looking back into my notes I see that the pundits have been warning about such an event for almost 2 years. This time I think they may be right.

Frankly, the lower earnings are what led me to my recent remarks on the new drive to invest in bonds. Unfortunately the changes in the market since that article (less than two weeks ago!) have made the situation far less clear. Bonds are also paying pretty lousy rates right now so it's hard to justify a somewhat risky 5.75% bond when I can leave money in my brokers super-savings account and get 5.05%.

Bottom line is this: we are headed into the busy economic and earnings season. Investors will be looking for hints on where the economy is going, especially given all the recent changes in the investing situation. The december shopping season was stronger than expected, but oil is dropping fast and much of the market earnings gains have been due to oil companies. We've enjoyed a market pop upward due to declining oil but now we face potentially lower earnings reports due to the same thing. Overall it's better for the economy if people aren't spening as much on oil, but in an uncertain environment lower earnings growth is likely to result in unhappy stockholders.

How bad will the earnings be? Current projections are that this will be the first quarter in a very long time with single digit growth in earnings (year over year basis). Looking back into my notes I see that the pundits have been warning about such an event for almost 2 years. This time I think they may be right.

Frankly, the lower earnings are what led me to my recent remarks on the new drive to invest in bonds. Unfortunately the changes in the market since that article (less than two weeks ago!) have made the situation far less clear. Bonds are also paying pretty lousy rates right now so it's hard to justify a somewhat risky 5.75% bond when I can leave money in my brokers super-savings account and get 5.05%.

0 Comments:

Post a Comment

<< Home